Blog

What Is Private Money

“ I love money more than the things it can buy... but what I love more than money is other people's money. ” - Lawrence Garfield

Private Money: Investing Simplified

Creative financing solutions for Fix & Flip real estate investors.

What Is Private Money?

While traditional loans depend on the borrower’s credit score, employment status, debt to income ratio etc., private money offers other creative ways of qualification. The majority of the time, private money loans are secured by the property that is being acquired or by another asset. These kinds of loans are great for short term investment strategies and transactional funding.

Benefits Of Using Private Money

When you find yourself in a need of funding for a business venture or an investment especially in real estate, a loan like this will be just what you need. Here are some benefits of private real estate loans vs. a traditional mortgage loans.

Fast Funding – If everything goes according to plan, a private money loan can take a few days to get funded as opposed to a traditional loan, which can take weeks or even months.

Flexible Terms – Working with your loan officer on the terms that work for you allows more flexibility to design the loan that serves your situation best.

Less Paperwork – Because the loan will secured by an asset rather than the borrower, less paper work and documentation is needed to process the loan.

Get Better Deals – Being able to bring fast cash to the table allows for better negotiations and better deals.

Borrow More Money – Private money lenders can lend up to 100% of the purchase price with no money from your pocket.

Easy Loans For Fix & Flip – Unlike traditional mortgage loans, private mortgage lenders love funding Fix & Flip investments.

How To Qualify For A Private Money Loan

Because the funding process will most likely go quickly once you begin and because the loan will be secured by the property in question, the most important thing that needs to be done first is finding and securing the property you want to invest in. Without the property being under contract, the lender will not want to invest time in working with you without a specific property to work with.

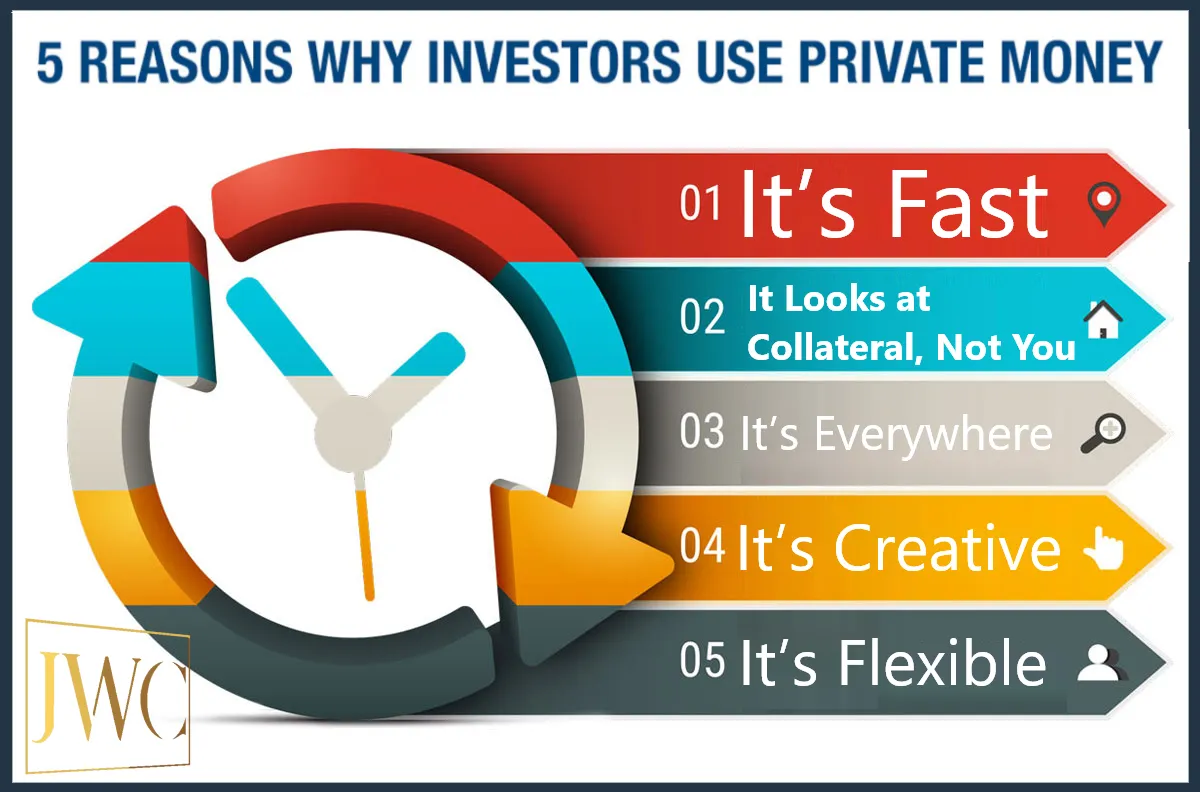

5 Reasons Why Investors Use Private Money

1.) Fast Funding:

Time is money in the real estate business. Unlike traditional loans that can take weeks or even months, private money loans can be processed and funded within a few days or a couple weeks.

2.) Bad Credit? No Problem:

Private money loans don’t need you to have good credit, the property that is going to be backing the loan is the only thing that will be looked at to make sure it qualifies.

3.) Real People Lending Money:

People with money sitting in low paying CD’s and other investments are looking for better opportunities for their money which is where you come in with your real estate flip. It’s a win win for both sides.

4.) Creative Opportunities:

Banks stay away from loaning money for fix and flip projects but private investors love this kind of opportunities. This is why they are able to provide creative funding solutions.

5.) Flexible Terms:

Traditional loans are bound by strictly-enforced guidelines. Private money lenders understand this business better and are more willing to work with you to create a loan that works for your project.

J.W. Crawford Management and The Unbound Entrepreneur are here to help. If you are ready to leverage a wide range of funding sources, optimize your credit, attract investors, and nurture lasting relationships.

Every effort has been made to accurately represent our programs and the educational value they provide. However, there is no guarantee that you will earn any money using the techniques and ideas in these materials. When we present revenue and sales profits in our presentation and our other channels, we are showcasing exceptional results, which do not reflect the average experience. You should not rely on any revenue, sales, or earnings information we present as any kind of promise, guarantee, or expectation of any level of success or earnings. Your results will be determined by a number of factors over which we have no control, such as your financial condition, experiences, skills, level of effort, education, and changes within the market. Running a business carries risks, and your use of any information contained on this presentation is as at your own risk. By continuing to listen to our content, you agree that we are not responsible for any decision you may make regarding any information presented or as a result of purchasing any of our products or service. Every effort has been made to accurately represent our programs and the educational value they provide. However, there is no guarantee that you will earn any money using the techniques and ideas in these materials. When we present revenue and sales profits in our presentation and our other channels, we are showcasing exceptional results, which do not reflect the average experience. You should not rely on any revenue, sales, or earnings information we present as any kind of promise, guarantee, or expectation of any level of success or earnings. Your results will be determined by a number of factors over which we have no control, such as your financial condition, experiences, skills, level of effort, education, and changes within the market. Running a business carries risks, and your use of any information contained on this presentation is as at your own risk. By continuing to listen to our content, you agree that we are not responsible for any decision you may make regarding any information presented or as a result of purchasing any of our products or service.