Professional Service Providers

Build your profit

generating brand

*Your brand strategy should clarify your message, generate

more leads, inspire client buy-in, and authority driven action

Trusted by leading investors, managers, and service providers

We design high-conversion brand strategies for service professionals, helping you attract more prospects and close more deals.

So you can focus on delivering high-quality services and avoid revenue fluctuations, profit plateaus, and business paralysis

We'll help design your brand for Purpose

Turn your brand into a defined vision that will inspire your customers, clients, teams, and stakeholders. Are your message and mission getting lost in translation? It's time to transform your vision into a compelling narrative that resonates with your customers, clients, teams, and stakeholders. As your strategic branding coach, I specialize in guiding you through the process of crystallizing your ideas into a defined mission and vision that translates into measurable results and profit.

A clearly articulated strategy is the difference between inspiring action and being ignored. Together, we'll harness the power of your newly defined story and vision to craft a strategic roadmap that sets your brand apart. In today's crowded marketplace, clarity is key. Without a well-defined strategy, your message risks getting lost in the noise. I'll work closely with you to develop a comprehensive strategy that cuts through the clutter and commands attention.

position your brand for authority

position your brand for authority

A clearly articulated strategy is the difference between inspiring action and being ignored. Together, we'll harness the power of your newly defined story and vision to craft a strategic roadmap that sets your brand apart. In today's crowded marketplace, clarity is key. Without a well-defined strategy, your message risks getting lost in the noise. I'll work closely with you to develop a comprehensive strategy that cuts through the clutter and commands attention.

systematize your PROcess for scalability

The exact framework you need to deliver a compelling memorable story. Together we will walk step-by-step through a proven framework that simplifies strategic branding and empowers you to take control of your narrative. We'll build a roadmap that positions your brand for success and leaves a lasting impression on your audience.

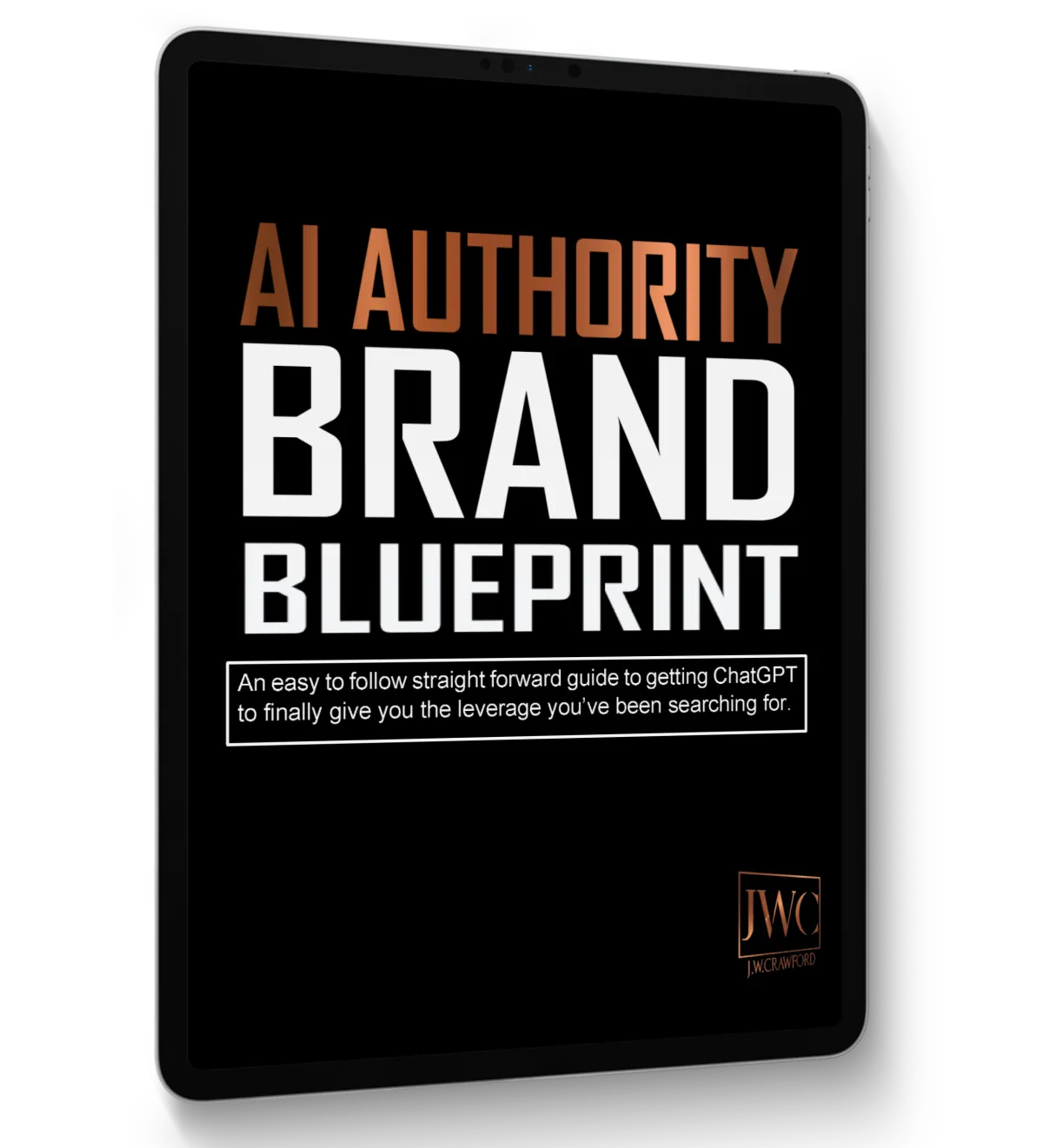

In Just 1 Hour You Can Unlock the

Potential of AI for Your Business

Download “AI AUTHORITY BRAND BLUEPRINT"

This is the guide to getting the most out of ChatGPT for your business

Refine your message to reflect your brand’s unique voice.

Leverage the power of AI to improve your online presence and be seen by the right prospects at the right time

Elevate your market position to become the authority in your niche.

Our Promise To You:

Credibility, Authority, and a Powerful Framework to Support It

Transform Your Business To Transform Your Future.

Join us in building a transformative system designed with you in mind. The busy professionals, executives, and owners who don't have time for fluff and fanfare. If you want to engage in an implementation modeled system that will quickly take your ideas, services, and culture and turn them into a fully designed, realized, and profitable brand contact us today.

Start building a brand that sets you

apart as a leader in your field.

What is the key to your

brand & business success

If You've Been Looking For A Way To Grow Your Business, You Have No Doubt Heard

1 If Not All Of These Being Screamed Accross Your Social Media And Article Feeds.

(So which one is it?)

FUNNELS

Just copy our $20 Million Funnel and scale to 7 figures in 30 days!

CONTENT

It's King! Write, post, record, post, eat, post, think, post... If you post 3x a day every day then customers will just come to you!

WEBINARS & VSL's

Do webinars and you'll sell like never before without ever talking to a prospect!

PAID ADS

Bet it all on Black and put your money on ads because it's the easiest way to get quality leads fast!

WEBSITE & SEO

Because no one can find you without it and your prospects won't take you seriously or buy from you if you have a 'bad' website.

None of them!

Truth is, these things can help create leverage and scale in your business, but will not produce consistent results without having the key in place.

Without this key you will spend a lot of time and money just hoping that you get it right before you burn out mentaly, emotionaly, and financialy.

So what is this key?

The key to being successful in your business and scaling is starting with an actionable brand strategy. One that is designed to do more than create a logo and a slogan.

It's a deep understanding of the true reason for your business and who it serves.

Establishing this strategic approach to actionable branding will save you from experiencing the 3 things holding back most service focused businesses today.

FEELING OF OVERWHELM

Stressed trying strategies that aren’t producing results yet you’re going through course after course and still not getting the results.

BEING A COMMODITY

Looking and acting like everyone else and not standing out. When you become commoditized you join the race for the cheapest service they can find.

LUCK AS A STRATEGY

Hope and wish are not strategies. This will leave you on a constant revenue roller coaster without a predictable way to scale.

It's time to get real results and J.W. Crawford is here to help you.

the strategy and the implementation

Attract A Mostly Automated Lead Flow So You Can

Predictably Acquire More Clients Systematically And Consistently.

(without needing to become a marketing expert)

We focus on the relationships

as much as the results

Our Clients Love Us

"I just highly recomend you Joe! Your good!"

"Within 5 minutes of talking with Joseph you will have that confidence that you're wanting."

"You've done everything you said...You instill confidence in me"

"It feels personal. It doesn't feel like we're just another client"

1st Shield Financial

"His knowledge and client-focused approach demonstratively delivered excellence for outstanding results."

-Kim B.

360 Property Group

"He is a valuable asset for any team, he embodies the qualities of a dedicated and caring professional. I surely look forward to doing more work with him in the future!"

-Mack H.

Gold Harvest Group

"Working with Joseph was a breath of fresh air into the noise of marketing. He asked great questions to really get to know who I am and what my business does."

-Roman L.

Symmetry Financial

"It has been a pleasure working with Joseph. Online and social media is like a foreign language to me. I had been extremely successful just making the dials. But I am so happy they implemented LinkedIn and Google My Business for me. I now have a team that is setting appointments for me and getting great traction to my website."

-Shonda S.

Every effort has been made to accurately represent our programs and the educational value they provide. However, there is no guarantee that you will earn any money using the techniques and ideas in these materials. When we present revenue and sales profits in our presentation and our other channels, we are showcasing exceptional results, which do not reflect the average experience. You should not rely on any revenue, sales, or earnings information we present as any kind of promise, guarantee, or expectation of any level of success or earnings. Your results will be determined by a number of factors over which we have no control, such as your financial condition, experiences, skills, level of effort, education, and changes within the market. Running a business carries risks, and your use of any information contained on this presentation is as at your own risk. By continuing to listen to our content, you agree that we are not responsible for any decision you may make regarding any information presented or as a result of purchasing any of our products or service. Every effort has been made to accurately represent our programs and the educational value they provide. However, there is no guarantee that you will earn any money using the techniques and ideas in these materials. When we present revenue and sales profits in our presentation and our other channels, we are showcasing exceptional results, which do not reflect the average experience. You should not rely on any revenue, sales, or earnings information we present as any kind of promise, guarantee, or expectation of any level of success or earnings. Your results will be determined by a number of factors over which we have no control, such as your financial condition, experiences, skills, level of effort, education, and changes within the market. Running a business carries risks, and your use of any information contained on this presentation is as at your own risk. By continuing to listen to our content, you agree that we are not responsible for any decision you may make regarding any information presented or as a result of purchasing any of our products or service.